Crude Oil Reverses at Midday

SubscribeWe commit to never sharing or selling your personal informationinitially tried to rally during the trading session on Wednesday, but turned around to show signs of exhaustion., so now the next question is whether or not that head and shoulders neck line will offer support on a pullback?

The 50-Day EMA sits right underneath there as well, so if that area doesn’t hold, that would be a very negative turn of events.If in fact it does not hold, I would anticipate that the market could go down to the $80 level. It’s also worth noting that the market recently formed a little bit of a “double bottom”, and therefore it’s likely that we will look at that area as a potential floor in the market and it should offer quite a bit ofThat being said, I think the negative argument for crude oil is the fact that we are heading into a major recession, as the world economic momentum is dropping.

above, suggesting that the inverted head and shoulders pattern was of course something worth paying attention to, and therefore a lot of technical traders would more likely than not jump into the market based upon the action.Ready to trade

Canada Latest News, Canada Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

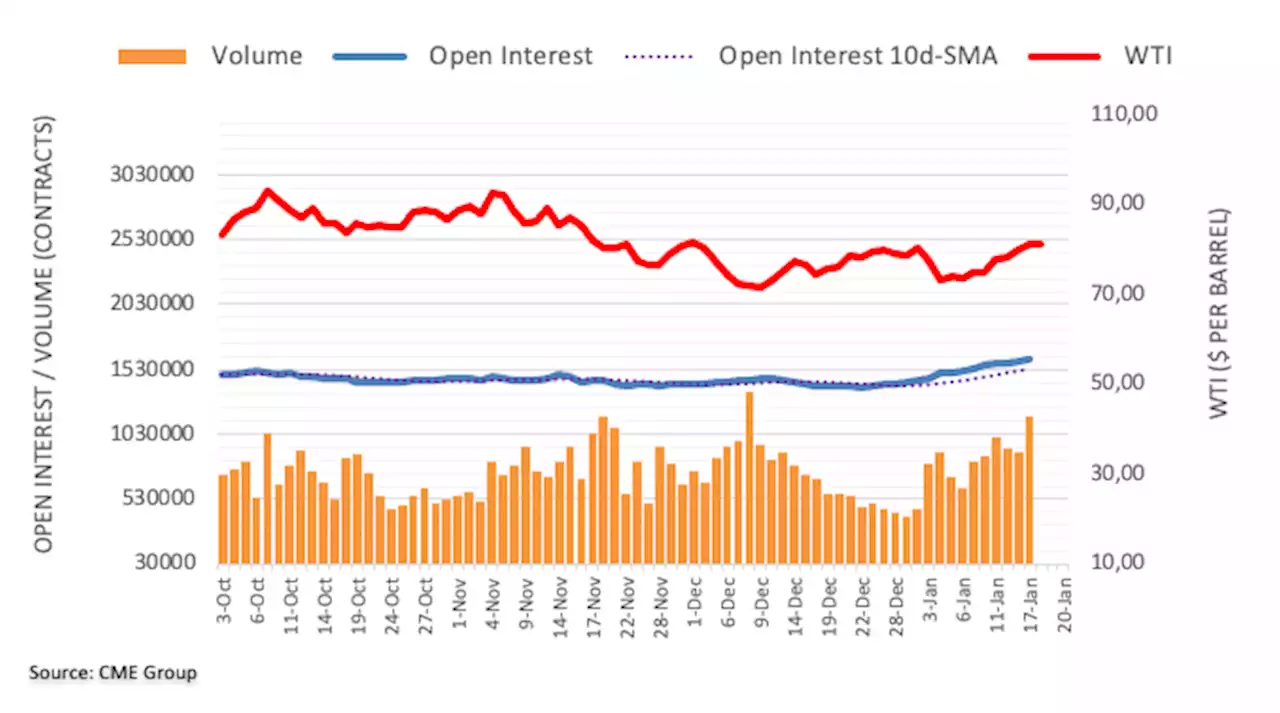

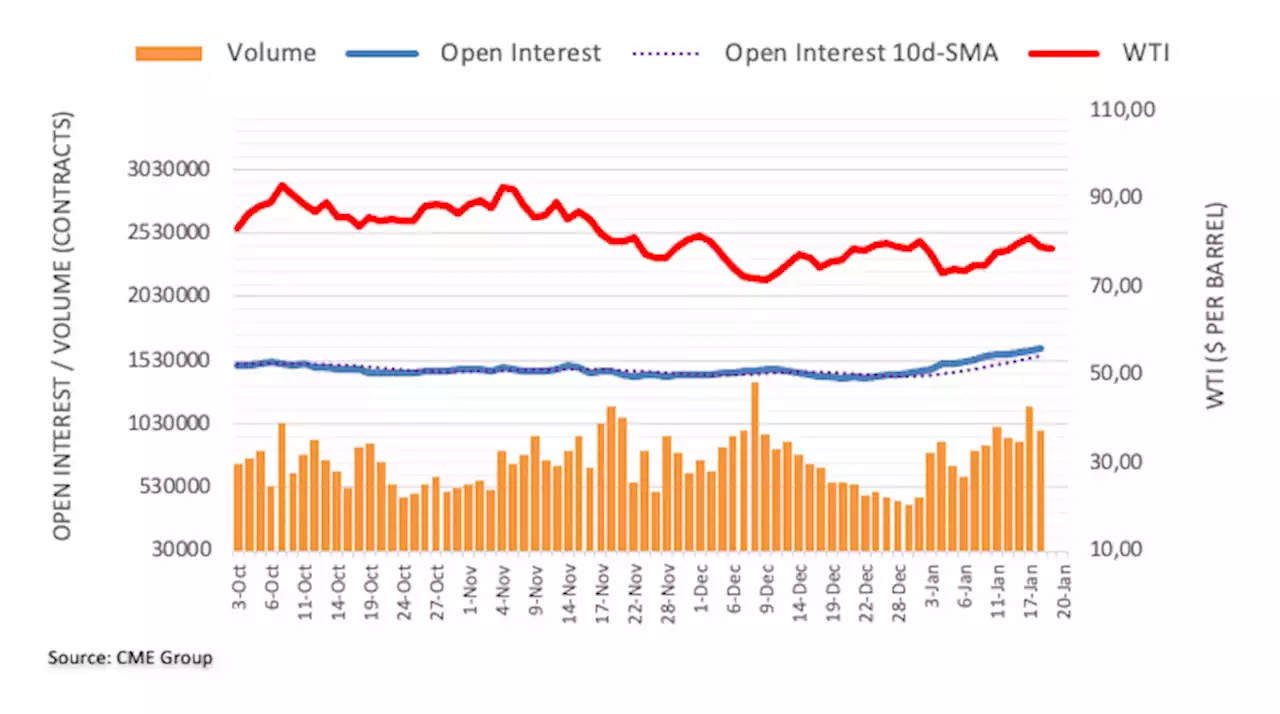

Crude Oil Futures: Extra gains on the cardsConsidering advanced prints from CME Group for crude oil futures markets, traders increased their open interest positions for the second session in a

Crude Oil Futures: Extra gains on the cardsConsidering advanced prints from CME Group for crude oil futures markets, traders increased their open interest positions for the second session in a

Read more »

WTI crude oil stays depressed around mid-$79.00s amid fresh recession fearsWTI crude oil holds lower ground near $79.50 amid early Thursday, after witnessing a heavy sell-off from the 1.5-month high the previous day. In doing

WTI crude oil stays depressed around mid-$79.00s amid fresh recession fearsWTI crude oil holds lower ground near $79.50 amid early Thursday, after witnessing a heavy sell-off from the 1.5-month high the previous day. In doing

Read more »

Oil down 1% on another surprise build in U.S. crude stocksOil prices fell on Thursday after industry data showed a large unexpected increase in U.S. crude stocks for a second week, heightening concerns of a drop in fuel demand.

Oil down 1% on another surprise build in U.S. crude stocksOil prices fell on Thursday after industry data showed a large unexpected increase in U.S. crude stocks for a second week, heightening concerns of a drop in fuel demand.

Read more »

Oil down $1 on bearish U.S. data, crude stocks buildOil futures fell as much as $1 on Thursday over recession fears as a sharp decline in U.S. retail sales and manufacturing output muddied the outlook for demand, while industry data showing a surprise jump in U.S. crude stocks also weighed on prices.

Oil down $1 on bearish U.S. data, crude stocks buildOil futures fell as much as $1 on Thursday over recession fears as a sharp decline in U.S. retail sales and manufacturing output muddied the outlook for demand, while industry data showing a surprise jump in U.S. crude stocks also weighed on prices.

Read more »

Crude Oil Futures: Extra losses in storeOpen interest in crude oil futures markets increased for the third day in a row on Wednesday, now by around 8.1K contracts according to preliminary re

Crude Oil Futures: Extra losses in storeOpen interest in crude oil futures markets increased for the third day in a row on Wednesday, now by around 8.1K contracts according to preliminary re

Read more »

Oil down nearly $1 on bearish U.S. data, crude stocks buildOil futures fell by nearly $1 on Thursday, extending losses from the previous day, as a surprise jump in U.S. crude stocks weighed on the market along with fears of a recession that were heightened by disappointing U.S. retail sales and output data.

Oil down nearly $1 on bearish U.S. data, crude stocks buildOil futures fell by nearly $1 on Thursday, extending losses from the previous day, as a surprise jump in U.S. crude stocks weighed on the market along with fears of a recession that were heightened by disappointing U.S. retail sales and output data.

Read more »