(Bloomberg) -- For one Citigroup Inc. trader in London, the morning of May 2, 2022 went from bad to worse. Most Read from BloombergThese Flight Routes Suffer...

One Dead After Singapore Air Flight Hit By Severe TurbulenceBarclays Managers Warn Some Staff to Prepare for Five Days a Week in Office

Markets immediately started going haywire. Within minutes, the trader realized the mistake and canceled the order. But the damage was done: The blunder had sparked a five-minute selloff in European stocks, wreaking havoc in bourses stretching from France to Norway. The bank’s algorithmic service desk, which normally oversees the real-time monitoring of internal executions, had decided to transfer those responsibilities to the electronic execution desk because it had staff out on scheduled leave that day.

The bank sets a series of thresholds for each type of block. If a trade triggers one of these, a pop-up appears. Soft blocks can be overridden, but not hard blocks. The penalties come as a blow to Citigroup’s equities trading unit, led by Fater Belbachir. The division has spent years trying to climb the ranks of stock trading, but it remains far behind rivals like Goldman Sachs Group Inc. or JPMorgan Chase & Co.

Canada Latest News, Canada Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

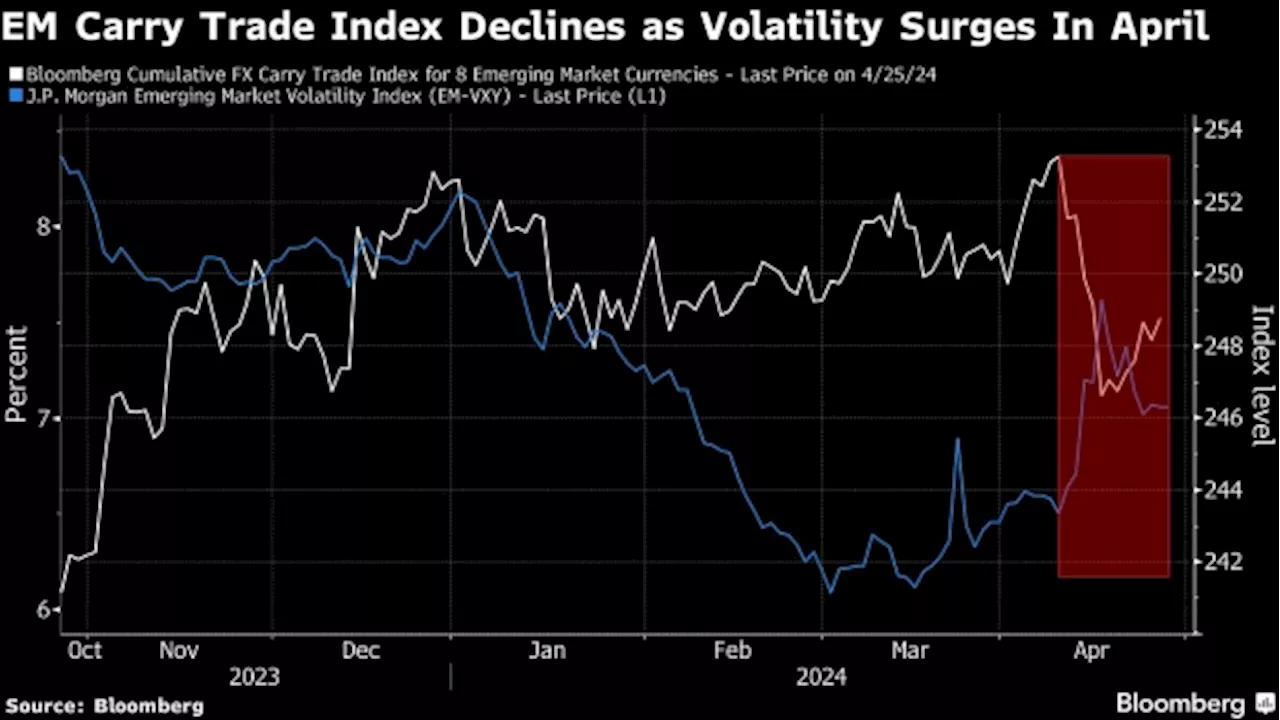

Citi, JPMorgan See Carry Trade Revival as Fed Hawkisness SpreadsEmerging-market currencies will be attractive for carry traders as hawkishness has been spreading from the Federal Reserve to many developing central banks, according to strategists from Citigroup Inc. and JPMorgan Chase & Co.

Citi, JPMorgan See Carry Trade Revival as Fed Hawkisness SpreadsEmerging-market currencies will be attractive for carry traders as hawkishness has been spreading from the Federal Reserve to many developing central banks, according to strategists from Citigroup Inc. and JPMorgan Chase & Co.

Read more »

A Stock Trader’s Guide to Xi’s Europe Visit Amid Trade TensionsChinese businesses from electric vehicles to infrastructure have much at stake from President Xi Jinping’s visit to Europe this week as trade tensions simmer.

A Stock Trader’s Guide to Xi’s Europe Visit Amid Trade TensionsChinese businesses from electric vehicles to infrastructure have much at stake from President Xi Jinping’s visit to Europe this week as trade tensions simmer.

Read more »

Ex-Jane Street Trader Pillories Claims He Stole Trade SecretsA former Jane Street Group trader who moved to Millennium Management ridiculed his former employer’s claims that he used its secret strategy to make a killing at his new job in India’s options market.

Ex-Jane Street Trader Pillories Claims He Stole Trade SecretsA former Jane Street Group trader who moved to Millennium Management ridiculed his former employer’s claims that he used its secret strategy to make a killing at his new job in India’s options market.

Read more »

Citi sees chance of Fed rate cut in June or July: EconomistThe Federal Reserve's case on whether or not to cut interest rates in 2024 is still not settled, leading many Wall Street analysts to adjust their forecasts ...

Citi sees chance of Fed rate cut in June or July: EconomistThe Federal Reserve's case on whether or not to cut interest rates in 2024 is still not settled, leading many Wall Street analysts to adjust their forecasts ...

Read more »

Citi strategist expects a 'beat and hold' earnings seasonNearly three-fourths of the S&P 500 companies (^GSPC) that have reported their first-quarter results so far have posted positive earnings surprises...

Citi strategist expects a 'beat and hold' earnings seasonNearly three-fourths of the S&P 500 companies (^GSPC) that have reported their first-quarter results so far have posted positive earnings surprises...

Read more »

Citi Strategists Say Buy Dips in Global Stocks on Solid EarningsGlobal equities are more attractive after the recent rout removed market froth and as investors focus on robust corporate earnings, according to Citigroup Inc. strategists.

Citi Strategists Say Buy Dips in Global Stocks on Solid EarningsGlobal equities are more attractive after the recent rout removed market froth and as investors focus on robust corporate earnings, according to Citigroup Inc. strategists.

Read more »