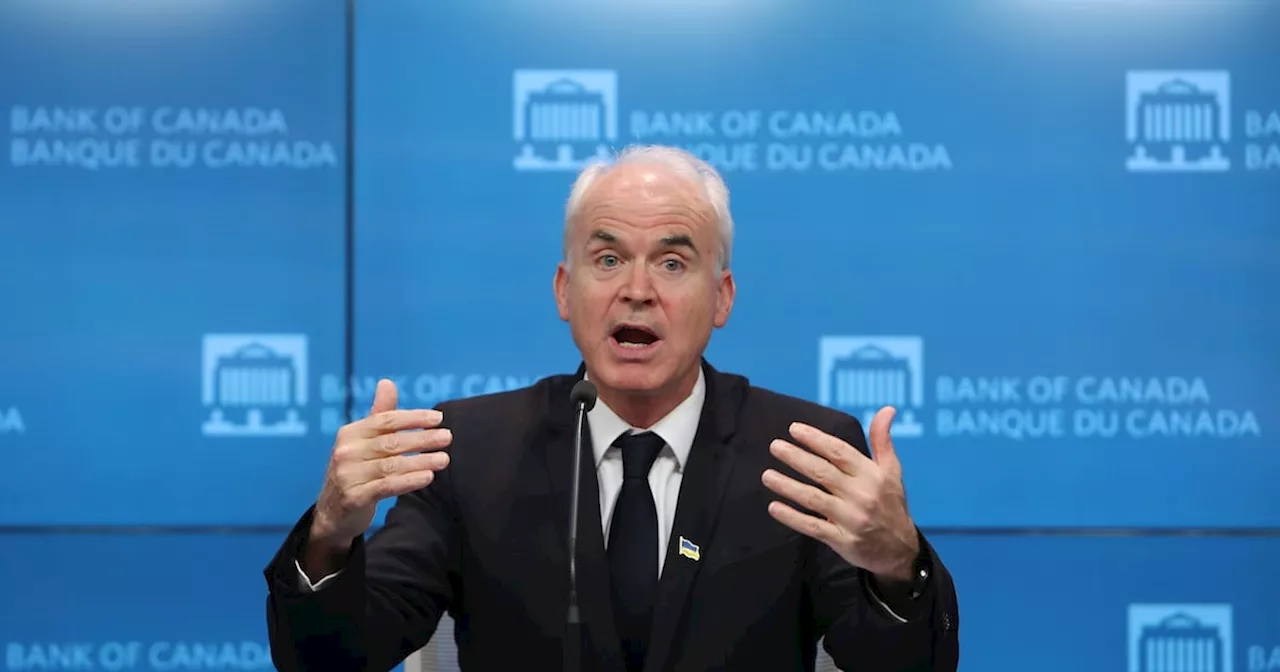

The Bank of Canada believes its recent rate cuts are helping to curb inflation, but is closely monitoring the economy for any signs of weakness.

OTTAWA — The Bank of Canada's governing council expects its second straight outsized interest rate cut helped it turn a corner in its fight to tame inflation, but it is watching the economy closely amid weaker than expected growth. The central bank’s summary of deliberations released Monday offers a glimpse into the council’s discussions in the lead up to the Dec. 11 rate cut, which lowered its key interest rate by half a percentage point.

Members considered only cutting by a quarter-point, but ultimately brought the rate down to 3.25 per cent in a bid to bring it closer to its so called neutral rate, where it is neither slowing nor speeding up economic growth. They noted that lower immigration targets are likely to weigh on economic growth next year and that tariff threats from incoming U.S. president Donald Trump are a major new source of uncertainty. Council members also said they'd be considering further rate cuts, but would be taking a more gradual approach given the five consecutive cuts since June, and giving the economy time to respond to them. The next rate decision and quarterly economic forecast are scheduled for Jan. 29. This report by The Canadian Press was first published Dec. 23, 2024. Nick Murray, The Canadian Pres

Bank Of Canada Interest Rates Inflation Economy Growth

Canada Latest News, Canada Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Ex-Bank of Canada Official Sees Key Rate Hitting 2.75% SoonFormer Bank of Canada Deputy Governor Paul Beaudry expects policymakers to cut their key interest rate until it hits at least 2.75%, with the path beyond that point less clear.

Ex-Bank of Canada Official Sees Key Rate Hitting 2.75% SoonFormer Bank of Canada Deputy Governor Paul Beaudry expects policymakers to cut their key interest rate until it hits at least 2.75%, with the path beyond that point less clear.

Read more »

Bank of Canada Sees Rate Cut Turning Point, But Eyes Economic WeaknessThe Bank of Canada's governing council believes its recent interest rate cut has helped curb inflation, but is monitoring economic growth closely after weaker than anticipated performance.

Bank of Canada Sees Rate Cut Turning Point, But Eyes Economic WeaknessThe Bank of Canada's governing council believes its recent interest rate cut has helped curb inflation, but is monitoring economic growth closely after weaker than anticipated performance.

Read more »

Bank of Canada's Interest Rate Cuts Could Spark Mortgage Competition in CanadaThe Bank of Canada has initiated interest rate cuts, shifting the mortgage market outlook for 2025. As borrowing costs drop and fixed-rate loans come up for renewal, Canadian banks are expected to engage in a mortgage competition, following a year of subdued loan growth.

Bank of Canada's Interest Rate Cuts Could Spark Mortgage Competition in CanadaThe Bank of Canada has initiated interest rate cuts, shifting the mortgage market outlook for 2025. As borrowing costs drop and fixed-rate loans come up for renewal, Canadian banks are expected to engage in a mortgage competition, following a year of subdued loan growth.

Read more »

Canada's Bank Sees Inflation Returning to Normal LevelsBank of Canada expects inflation to ease back to 2% as annual rate settles, allowing for better spending and investment confidence. However, potential U.S. tariffs unilateral tariffs could disrupt this trend and fuel inflation again.

Canada's Bank Sees Inflation Returning to Normal LevelsBank of Canada expects inflation to ease back to 2% as annual rate settles, allowing for better spending and investment confidence. However, potential U.S. tariffs unilateral tariffs could disrupt this trend and fuel inflation again.

Read more »

Canada’s unemployment rate rate hits high not seen since 2017, outside pandemicEconomy added 51,000 jobs in November, with gains concentrated in full-time work

Canada’s unemployment rate rate hits high not seen since 2017, outside pandemicEconomy added 51,000 jobs in November, with gains concentrated in full-time work

Read more »

Canada's 6.8% jobless rate boosts bets for 50-point interest rate cutCanada had 1.5 million unemployed people in November, propelling its jobless rate to a near-eight-year high outside of the pandemic era and boosting chances of a large interest rate cut on Dec. 11.

Canada's 6.8% jobless rate boosts bets for 50-point interest rate cutCanada had 1.5 million unemployed people in November, propelling its jobless rate to a near-eight-year high outside of the pandemic era and boosting chances of a large interest rate cut on Dec. 11.

Read more »